A SIMPLE TRADING PLAN FOR MAKING GOOD MONEY ON IQ OPTION

For many new traders, coming up with a trading plan is one of the difficult activities they must engage in. Trading without a plan is like blindly shooting in the dark. You’re relying on luck to make money. And luck never works when it comes to trading.

After scouring the internet for good trading plans, I found that many of these did not cover the essential details. What many teach is how much to invest per trade. But they don’t cover other important aspects.

That’s why I’ve created this simple guide. Let’s get started.

What should go into your trading plan?

How long it will be in use

The first thing you must decide when creating a trading plan is how long you intend to use it. It could be one day, a week or a month. My trading plans are usually designed to last 1 week. This gives me enough time to test it and analyze its efficiency. If it works, I’ll continue using it for up to 1 month.

As long as I’m using this plan, I will document all trades I entered into. Luckily, IQ Option provides the trading history feature. This comes in handy when I want to have a quick glimpse of how my trades for a particular day did.

The trading strategy to use

There are many trading strategies out there. However, each trading plan should have one trading strategy. For purposes of this guide, I’ll use the TLS method coupled with support/resistance and the RSI indicator. The Guide to Using the Trend Level Signal to Make $249 should get you started with this strategy.

The reason why I chose the TLS method is that it’s simple to implement.

Asset and market to trade

Next, you’ll need to decide which asset and market to trade with best crypto platform. The asset could be a currency pair, stocks, indices etc. The market could be options, forex, CFDs etc. You should stick to one asset in one market. This makes it easier to keep track of your progress.

Once you’ve chosen your asset, you’ll need to decide when to trade. This largely depends on your timezone and your trading strategy.

Trading account

This covers three essential points.

The first is the amount you will deposit for the period of the trading plan. This is your account balance. You objective is to deposit a specific amount and then use it to make profit. If this amount is depleted, you should not make another deposit until you’ve created a different workable plan.

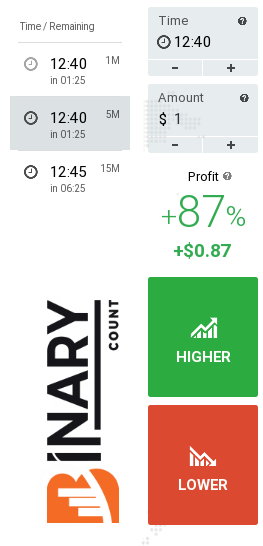

The second is how much you’ll invest per trade. This could be a fixed amount like $10 per trade. It could also be profits made per trade allowing you to return the initial investment to your account balance.

Finally, you should have a profit target. Having an overall profit target allows you to decide how much you want to make per trade as well as how many trades you need to make to achieve this target.

What to do when things don’t go according to plan

Sometimes, trades don’t go according to plan. For example, you might suffer consecutive losses leading to depletion of your account balance. In other hand, you might reach your profit target sooner than expected.

So what do you do when such scenarios occur?

Do you continue trading or stop trading? This is a subjective decision only you can make. However, make sure that the decision you make enables you to protect your money rather than lose it trading on IQ Option.

This also involves deciding what to do when emotions start clouding your judgment. If you’re tempted to increase your trade amount to recover losses, what do you do? This part involves identifying actions that you must take to prevent emotion-driven trading.

You’ve just learned the basic features that should go into your trading plan. Remember, a bad plan is better than no plan at all. Always ensure that you have a trading plan before making any trade. It could mean the difference between making money and losing it.

Now!, 12 Question you could ask your self to write down your own personal Trading plan.

How long it will my trading plan be Used?

Asset and market to trade?

What trading strategy do I use?

What expiration time do I use

What time frames do I Trade on?

What extra tools do I use? >> Check our Free Trading Tools!

Trading account Size?

Money Management?

Maximum Number of Trades per day?

Maximum Loses?

What are my Profit targets?

What happens if I don’t make my targets?

Of course, your trading plan is personal, and you can adjust question to your self.

Kindly share your own trading plan in the comments section below, so other traders can learn from yours.