The Different Types of Options on the IQ option platform

What are options? An option is a contract that gives you the right to buy or sell an asset at a preset price at a specified moment of time in the future.

Example of an option

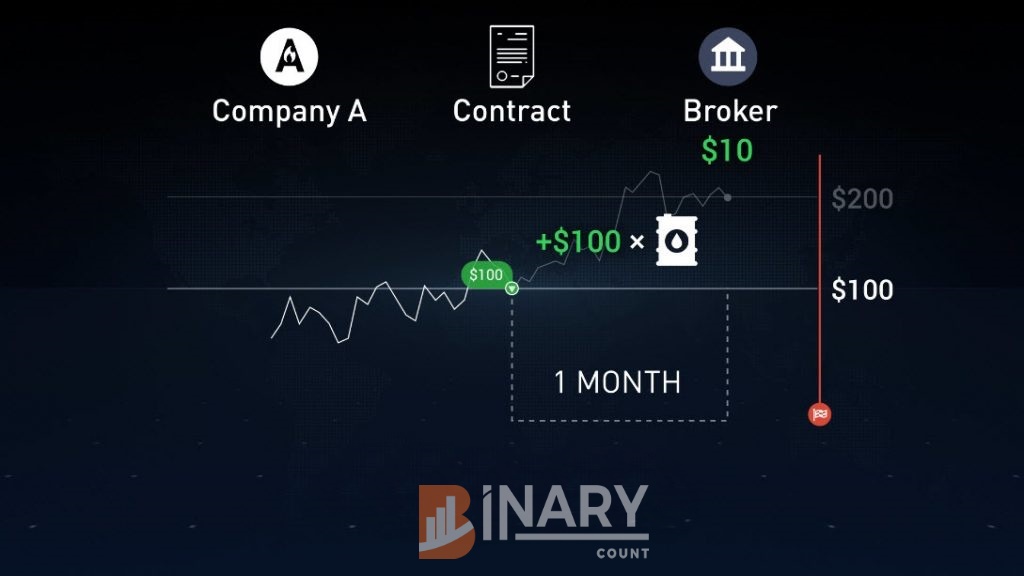

Let’s take an example. Company A sells petrol. The cost price of petrol includes among other things the cost of raw material. In our case it’s oil. Oil prices are changing constantly. So the company decides to use an oil options contract in order to mitigate the risk of oil price increase.

So how does the option contract work? For example, oil now costs 100 dollars per barrel. Company A goes to an exchange and concludes an options contract with a broker for purchasing oil at 100 dollars next month.

The company has to pay the cost of the option contract also called the option premium to the broker. For the sake of the example let’s say the option premium is 10 dollars. Now let’s study two scenarios.

One month later the price of oil rises to 200 dollars per barrel as Company A has the option contract for purchasing oil at one hundred dollars, it can use its option contract, exercise the option and buy oil at the agreed price of 100 dollars. Thus saving one hundred dollars per each acquired barrel.

Example use of put option when oil price is going up

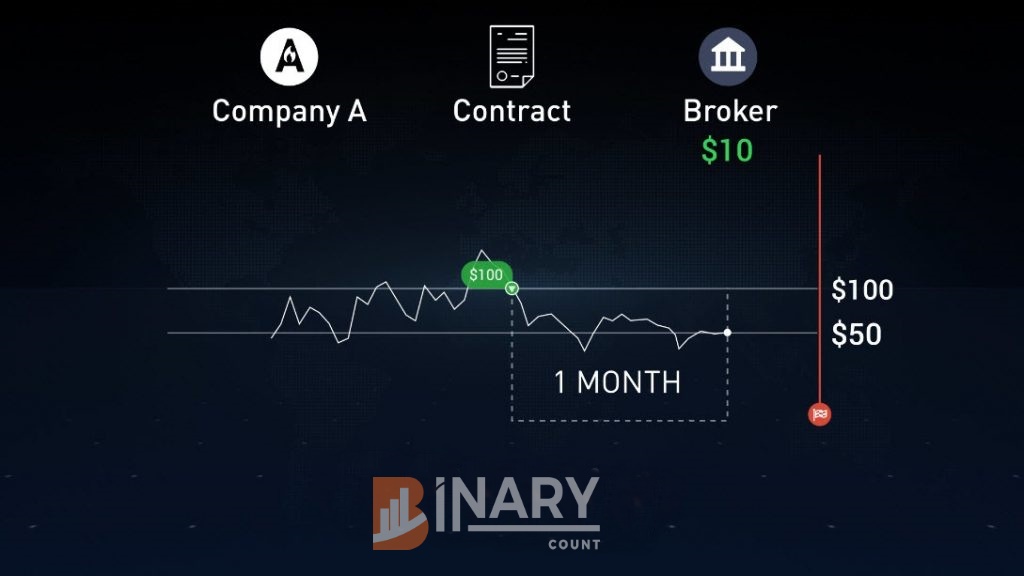

But what if the oil price drops to fifty dollars. In this case, there is no point in buying oil at the agreed price of 100 dollars. As the commodity is available at fifty dollars on the market. In this case, the company does not exercise the option and pays only the option premium to the broker.

Example use of put option when oil price is going down

Specific terms for trading options

Options trading has its specific terms:

The purchase time is the time when a trader buys an option.

The expiration time is the predetermined point in the future after which an option ceases to exist.

The price of an option contract is called an option premium.

The strike price is a target level that the opening price of an asset should go above or below for the position to close in the money.

Main types of options at IQ Option

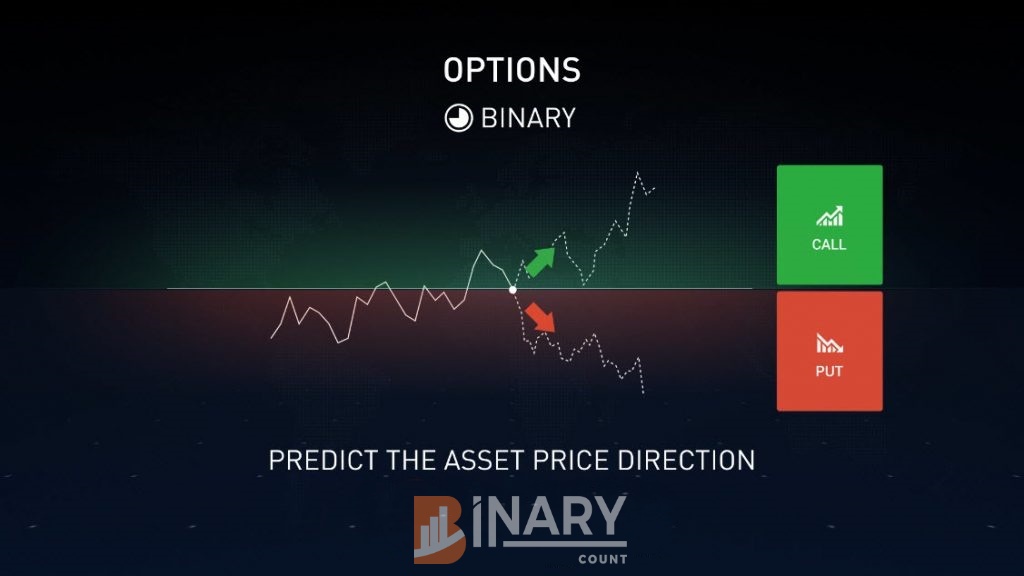

There are two main types of options. Call Options ‘calls’ and put options ‘puts’. A call option gives you the right to buy an asset, a put option gives you the right to sell an asset.

Call and put options

Options trading at IQ Option

Options is a popular trading instrument that has many variations at the best crypto platform. If you choose binary options trading you should predict the asset price direction whether the price will go up or down compared to the opening price.

direction whether the price will go up or down compared to the opening price.

Digital options allow you to choose strike prices. Thus managing your risk more efficiently.

Foreign exchange options or FX options give you the right to exchange one currency for another at a preset exchange rate at a specified moment in time in the future. FX options have strike prices like digital options. On IQ Option platform you can trade binary options, digital options and FX options.

Guide to IQ Option Tournaments

6 Reasons Why Binary Options are Popular

How to Use the IQ Option #1 Support and Chat Feature

IQ Option boasts hundreds of thousands of traders. It’s one of the platforms that’s designed to meet trader’s needs. Many of the platform’s improvements are allegedly made based on trader suggestions. One quick way to share your ideas with IQ Option staff is through their chats and support feature. But that’s not all you can do with this feature as you’ll find out in this article.

Overview of the IQ Option chats and support feature

This feature is found on the right hand panel of your trading account. You can access it on both the practice and real accounts. However, only real account holders can message chat members on this feature.

The chat and support feature allows traders to interact with each other directly. However, there are rules to adhere to. And in order to be allowed to communicate with other members, you must agree to these.

Is the Martingale Strategy Suitable for Money Management in Options Trading?

Complete Beginners Guide to IQ Option Forex Trading

Many new traders will opt to try out options over other financial instruments. They’re easy to trade and offer a fixed profit return. Besides options, IQ Option also offers other financial instruments. Among these is forex which will be my focus in this guide today.

Forex overview

The Foreign Exchange (Forex or fx) market is the largest in the world today with over $1 trillion being exchanged daily. This market involves exchanging different currencies.

The fx market developed as a result of trade and other financial transactions occurring between countries, institutions and individuals. For an fx transaction to occur, you must sell one currency to buy another or buy one currency by selling another. This means fx transactions involve currency pairs. For example, if you’re trading EUR/USD and 1.80086, it simply means that you can buy 1 Euro for 1.80086 US Dollars.

Where do forex prices come from?

Forex prices are usually determined by supply and demand. I use the term “usually” because there are other forces such as central banks, governments and even forex brokers who might manipulate forex prices.

But let’s stick to supply and demand. Each currency pair has a bid and ask price. The bid price is the amount someone is willing to sell the currency at a specific time. The asking price, on the other hand, is the amount someone is willing to pay for a particular currency at a specific time.

Now knowing who sets the prices isn’t that important for traders. Why?

Trading forex on IQ Option doesn’t require you actually own the currency you’re buying or selling. Your primary objective is knowing how to profit from buying and selling currency pairs.

I’ll cover this next.

How do you make money trading forex on IQ Option?

Trading forex involves buying and selling a currency pair. For example, if EUR/USD is trading at 1.1576/1.1578 it means that you can buy 1 EUR for $1.1576 or sell 1 EUR for $1.1578.

Now, if you decide to buy 1EUR for $1.1576 you’re hoping that its price will rise in the future allowing you to sell at a profit. Conversely, if you sell 1EUR for $1.1578, you’re hoping that the price will fall in the future allowing you to buy it back at a lower price.

The difference between your buying or selling price and the price at which you’ll buy or sell the currency for in the future will be your profit or loss.

So if you bought the EUR/SD pair at 1.1576 and the price rises to 1.1580, your profit would be $0.004.

That’s a small amount for most traders. But consider if you bought 100 lots. Your profit would be multiplied by 10000 earning you a profit of $40.

Note: A lot comprises 100 units. So if you bought 1 EUR/USD lot, it simply means you bought 100 EUR.

Who are you trading against in the forex market?

The forex market comprises dozens of different actors. Remember that the value of a currency is largely affected by its supply and demand. This means that when buying or selling a currency pair, you’re essentially competing against small actors such as independent traders. You’re also competing against big actors such as banks and governments.

But this shouldn’t be a cause for concern. No actor is big enough to control the forex markets, therefore, giving you an equal opportunity to make money as a small trader.

Forex vs Options markets

I’ve written the IQ Option Forex vs IQ Option Options Which is More Profitable?

This comprehensive guide will teach you more about the differences between these two markets. However, here’s a rundown of the 6 major differences you’ll encounter when trading forex on IQ Option.

Forex doesn’t have a set expiry time

When trading options, you’ll have to decide when the trade will expire. This can be as little as 1 minute or more than 1 month.

Forex, on the other hand, has no fixed expiry time. The trade is only exited if you manually close it, or if the price reaches a pre-set stop loss or take profit point. This means a trade can remain open for minutes, hours or even days.

Stop losses

The stop loss is a tool that’s used to limit the amount a forex trader can end up losing. For example, if you invest $100 in a trade, you can set your stop loss at 10%. This means that if the trade goes against you and your invested amount falls to $90, Iqoption will automatically close the trade.

When trading forex, losing trades can eat into your account balance. This means that if you invested $100, your losses can exceed this amount. Stop losses allow you to protect your account balance and limit losses on each trade.

Take profit

Take profit works the same way as the stop loss. There’s one major difference though. The take profit feature automatically closes the trade when a specific profit amount is reached.

For example, if you invest $100 and set your take profit at +$50, the trade will automatically close when a $50 profit is made.

This feature makes it easy to lock in and secure profits made on each trade. Imagine a trade where you had the opportunity to make $50 but the markets reversed. The profits you’d have earned start to dwindle simply because you didn’t take profits when the markets were favourable.

Leverage

IQ Option offers leverage to forex traders. What this simply means is that you are able to multiply the profitability of every trade. For example, if you trade using $100 and apply the leverage of X50, this essentially means you’re trading with $5000. In turn, the profits you make on your trade will be 50 times higher than if you had simply traded using $100.

Although leverage can be a great way to increase your profits, you should use it with caution. Always use it alongside other tools such as stop losses and take profit.

Trade exit

One thing that makes options trading easy is that trade exit is fixed. If you enter a 60-second options trade, you’re assured that you’ll know whether you’ve made a profit or not within 60 seconds

Forex trading is a bit different. Trade exit is determined by one thing – price. Unless the price reaches your strike price, the trade will remain open. This means that it can take minutes, days or even weeks before the trade exits. You can however manually exit the trade if you want to on the IQ Option platform.

Many forex traders, therefore, choose to trade currency pairs where price fluctuations are likely to occur during a trading session. This way, they’re sure that their strike price (take profit or stop loss) are going to be hit at a specific point. So if you want to trade forex, it’s recommended that you trade when the currency pairs you invest in are likely to be affected by a news item.

Returns

Binary Trading Option traders will get a fixed return per trade. Forex traders, on the other hand, have the chance to earn returns exceeding 100%. The reason for this is that how much profit you make as a forex trader largely depends on how far the price moves. The further the price moves according to your prediction, the higher the profit potential.

Now couple this with leverage and you have the opportunity to make profits that can be as high as 500% or more. This makes forex trading a good way to make huge returns in the financial markets.

There’s a downside however, your losses can also be much higher than the amount you invest per trade especially if you’ve not set any stop losses.

Now that you’ve got a basic understanding of how the forex market works, your next step involves trading the forex markets. The Ultimate IQ Option Forex Trading Guide for Beginner Traders is a post you’ll want to read to get you started.

A SIMPLE TRADING PLAN FOR MAKING GOOD MONEY ON IQ OPTION